All the people in my circle of friends, including my family, my relatives, my coworkers, and everyone else, are in debt. We often say things like, “I’ll simply take a soft loan and pay for it slowly since I can’t afford to pay for it in cash,” when we want to buy a car or other fixed assets. We don’t think for a moment and say, “What options do we have to buy an asset in cash?” It’s unfortunate that applying for a loan is simple hence we rarely consider paying in cash.

Since I started my second salaried job, I have been in debt. I have acquired every fixed asset I own with a bank loan. Particularly now that the procedure has become quite simple, you can now request for a loan in most countries while sitting comfortably in your home, place of business, or office because you just apply using your mobile phone and get the money within two days.

I’ve been fine making monthly payments to pay off my loan for a long time, but at the beginning of this year, I started thinking about other options. And some of these are the things I did:

-

I began by silently asking God to help me pay the remaining balance in six months.

-

Additionally, I discovered a verse in the Bible that states:

Proverbs 22:7

The rich rule over the poor,

and the borrower is slave to the lender.

I realized I was a slave to the lender because I had to make the instalments every month, regardless of whether I had money or not.

God provided me with a solution around the middle of February. Below find ways on how I began my quest to pay off my $29,000 debt in six months:

1. Developed a Spreadsheet

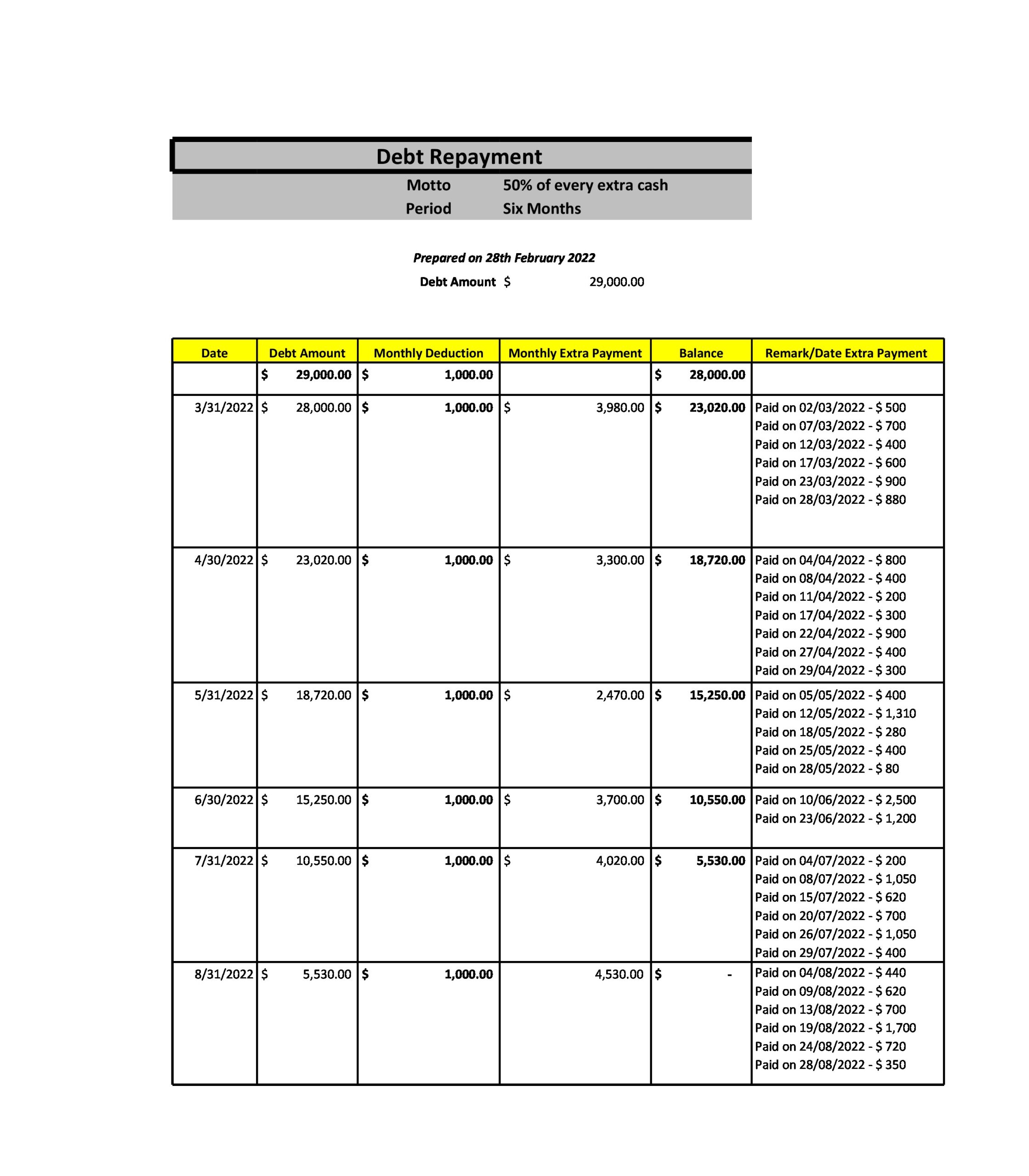

Making the spreadsheet was the first thing I did. It indicated the total amount of the debt I owed; I planned to make extra payments each month, and the regular monthly payments are also noted on the sheet. In the remark area, I listed the dates I made the additional monthly instalments.

2. 50% Extra Monthly Repayment

My guiding principle was to pay 50% of any cash I received, including gifts in cash, passive income from my blog, bonds, interest from money market funds, vegetables sold for cash, decluttering, rental property, discounts, offers, and others. I set aside 50% of every dollar I earned or received to pay off my debt.

Here is the spreadsheet:

3. Updated the Amortizer

I made sure to update Amortizer with the extra lump-sum payment made towards the debt monthly because it is the one that is associated to the loan bank statement.

Regardless of how much money you make from each source, having a variety of sources of income is necessary for easy repayments.

I’ll highlight a few of the easy money-making activities that everyone can engage in to help you contribute 50% to the repayment plan for your debt.

1. Blog

For most people, from college and university students to working from home moms, technology has made the entire globe into an e-office. The creation of a blog is one simple way to start making money online. You will undoubtedly make money from Google AdSense, Mediavine, numerous affiliate marketing programmes, e-books, e-commerce, and other sources by creating good content that benefits your audience. Search online, you’ll find countless people using their blogs to earn decent money online.

People who post content on their blogs can make up to $1,000 every month. If you do additional reading and research, you’ll discover something you can sell or do online to get money. When you pay off 50% of your debt, you’ll undoubtedly feel relieved every time you see the numbers go down. This will motivate you to work even harder and more smartly to earn more money.

2. Teach Languages Online

People from all over the world are interested in learning different foreign languages. Online access makes this possible. Keep an eye out for websites like ESL boards where you can get an online job teaching a language to children and adults. You can search for jobs on a lot of different reliable websites. From the income you’ll receive, put 50% toward your debt repayment.

3. Part-Time Rental Broker

Your friends, family, coworkers, and even their friends may be looking to rent a house, book a hotel room, rent an apartment or even Airbnb. Depending on what exactly a person is looking for, you can let them know if you have friends who own homes they can rent out or if you know any property brokers. You can also check online at:

-

-

Trip advisor

-

Booking.com

-

Hotels.com

-

Expedia

-

Travelocity

-

Agoda

-

You can get all the information online including contacts. To be sure, all you need to do is get in touch with the owners or property managers personally. You only need to conduct research and speak with people, not necessarily the clients, to carry out this type of part-time job. Once you have a client, you can find out what amenities they would like the property to have. Additionally, you’ll have access to reviews from popular websites, which will help you determine the quality of the property and the service as well as whether your potential client will be satisfied. The benefit of this type of work is that you can perform it part-time, set your own rate for clients, and get paid by the property owner when one of your recommendations results in a rental or hotel stay.

This is one of my favourite side hustles, and it has truly helped me pay off my debt. It’s a fantastic approach to make money if you think you can do it.

4. Virtual Assistant

Working as a virtual assistant can pay well. You can work comfortably from home, and since you set your own working hours, there are no defined schedules. Especially for moms, they will take care of the family as they work and generate income, which will assist to pay off the debt and leave you with cash because you are only contributing 50% toward the debt repayment. You require a good, functional computer and reliable internet for this kind of job.

There are many administrative duties carried out by virtual assistants.

Here are a few of the tasks they do:

-

Schedule appointments

-

Make phone calls

-

Manage emails

-

Make travel arrangements

-

Data entry

-

Send clients thank-you letters among other things.

A virtual assistant can make up to $50 per hour. A virtual assistant with expertise knowledge, such as graphic design, web development, SEO, copywriting, and other skills, can make up to $250 per week or $1,000 per month.

Here are some benefits of working as a virtual assistant:

-

Manage your schedule.

-

Set your own rates.

-

Work from home.

-

Work while you travel.

-

Relax while you work.

-

Save on transport costs.

-

Choose your own working space.

Pay off your debt with 50% of the money you earn as a virtual assistant.

Try it out as a side hustle while maintaining your fulltime job because this type of work is exciting. I recently added it to my side hustles, and I’m doing great. Due to my special skills in web development and design, I am currently making $180 per week. I am working hard to meet my goal.

The bottom line

You can achieve financial freedom by paying off your debt as quickly as possible with discipline and a solid strategy in place. You may devise a practical method for governing your finances while allowing you to live comfortably. My comfortable plan is to allocate 50% of every additional dollar I make toward paying down the debt. With multiple streams of income, it’s quite simple, and I still have 50% left over for savings and expenses.

The options for earning money are countless. Any concept you have in mind should be utilized, think about what you could create from or with it.

-

Selling produce from your garden

-

Decluttering

-

Rent a room

-

Start a daycare

-

Run errands

-

Execute tasks

-

Homemade soap for sale

-

Write articles

-

Surveys

-

Work online

-

Create business plans for startups.

The list goes on and on. While there is still so much to be done to make additional money to pay off the debts quickly, you don’t have to be completely in debt or pay high loan interest rates to the financial institutions.

This post may contain ads links. Please read our https://www.sallyfavourites.co.ke/disclaimer/ for more info.